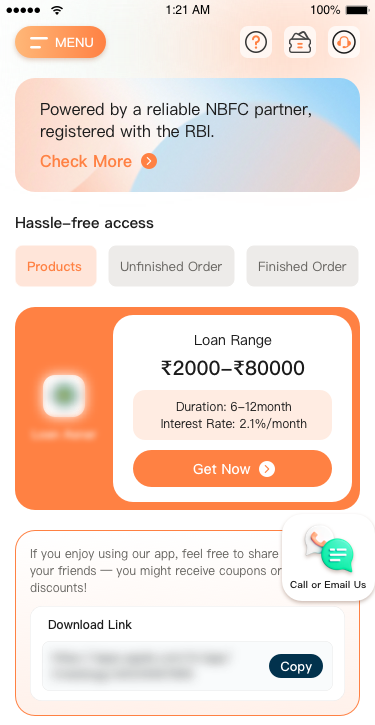

Loan Range: ₹2000-₹80000

Duration: 6-12month

Interest Rate: 2.1%/month

Service Fee: 3%

Max APR: 25.2%

(for ₹10,000 over 12 months)

Loan Amount: ₹10,000

Interest Rate: 2.1% per month

Duration: 12 months

Service Fee: 3% of ₹10,000 = ₹300

Amount Disbursed (Receive): ₹10,000 - ₹300 = ₹9,700

Monthly Interest: ₹10,000 * 2.1% = ₹210

Total Repayment: ₹12,520

Max APR: 25.2%

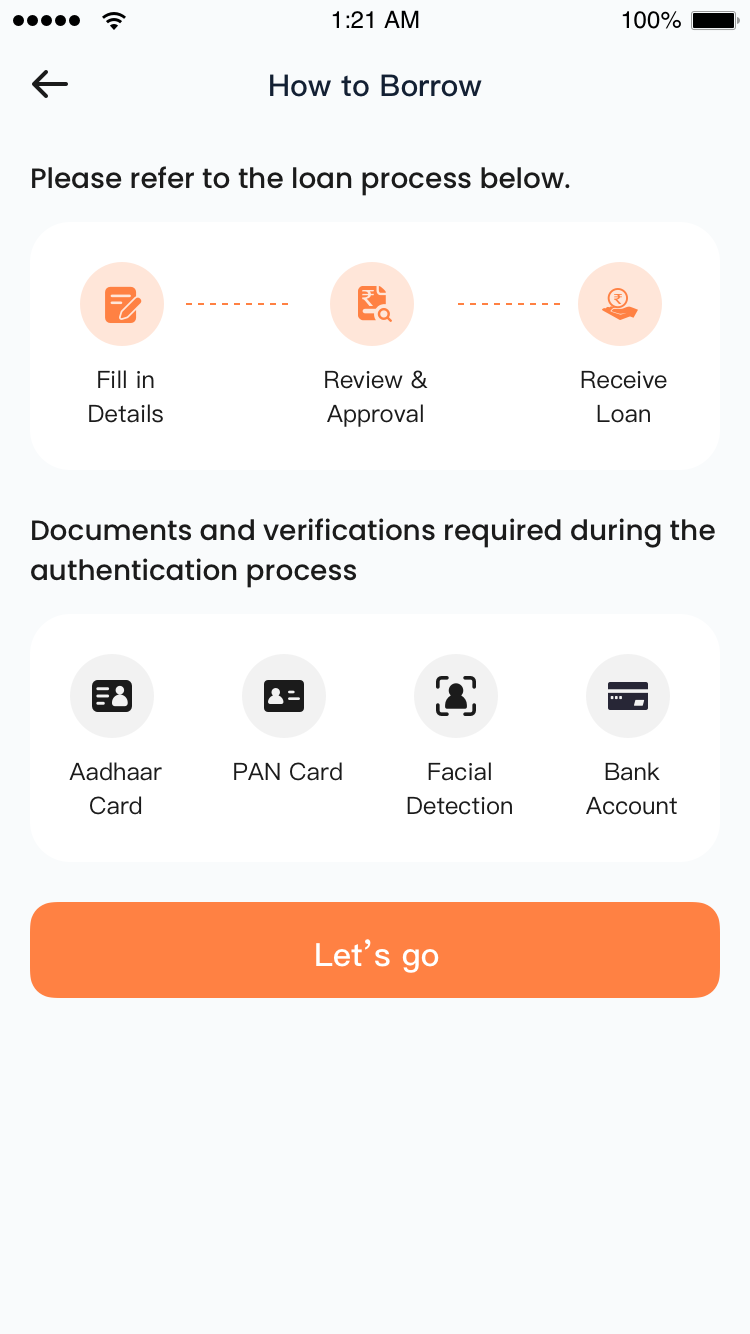

At ASNAR, we design and manage mobile-first lending apps that simplify access to personal credit for millions of users across India. We do not lend directly — instead, we partner with licensed Non-Banking Financial Companies (NBFCs) who serve as the direct lenders. Our role is to provide:

End-to-end loan platform development

App-based customer onboarding, KYC, and eligibility checks

Loan lifecycle management tools

Compliance support and technical integration

Customer support systems & payment gateways